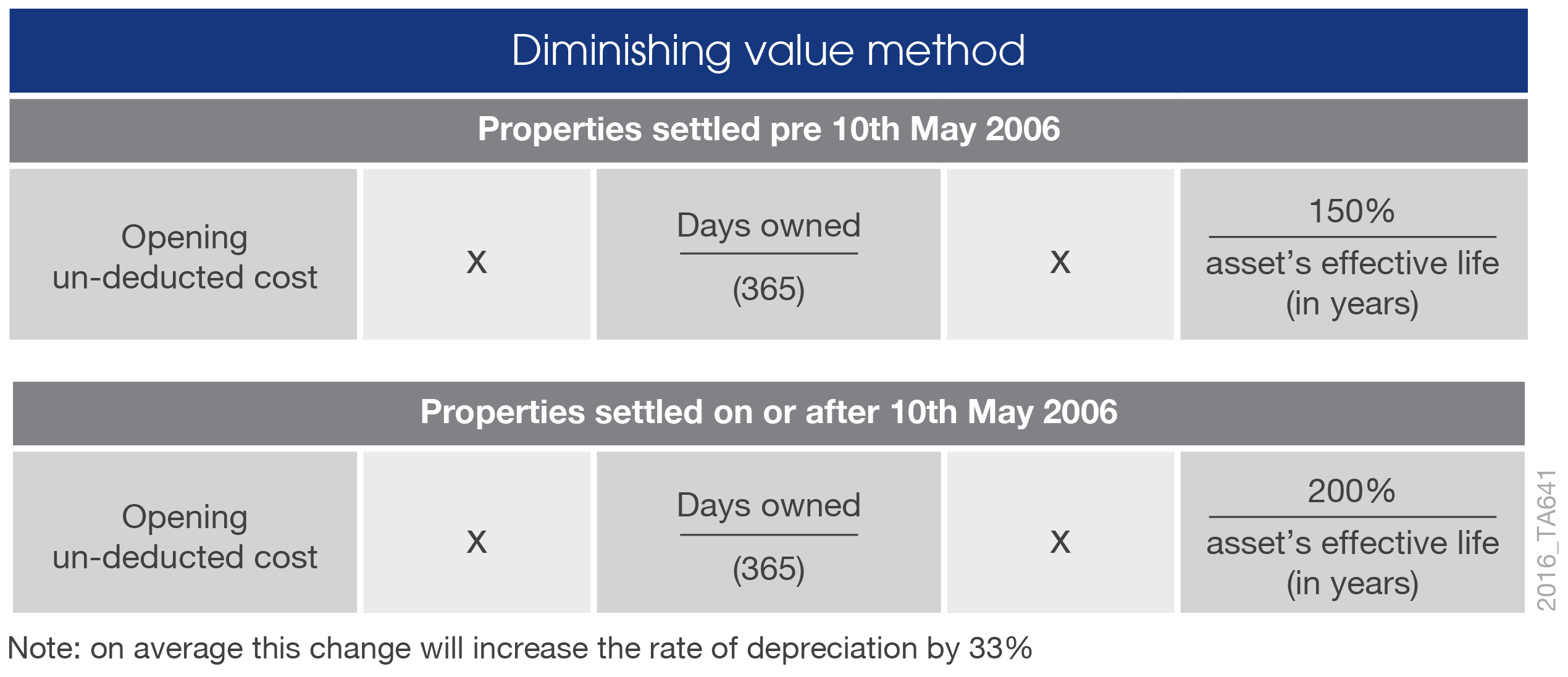

Owners can claim wear and tear on these items at a rate of 25 for up to forty years providing the property was built after September 15 1987. Ie no RCM under section 94 applicable.

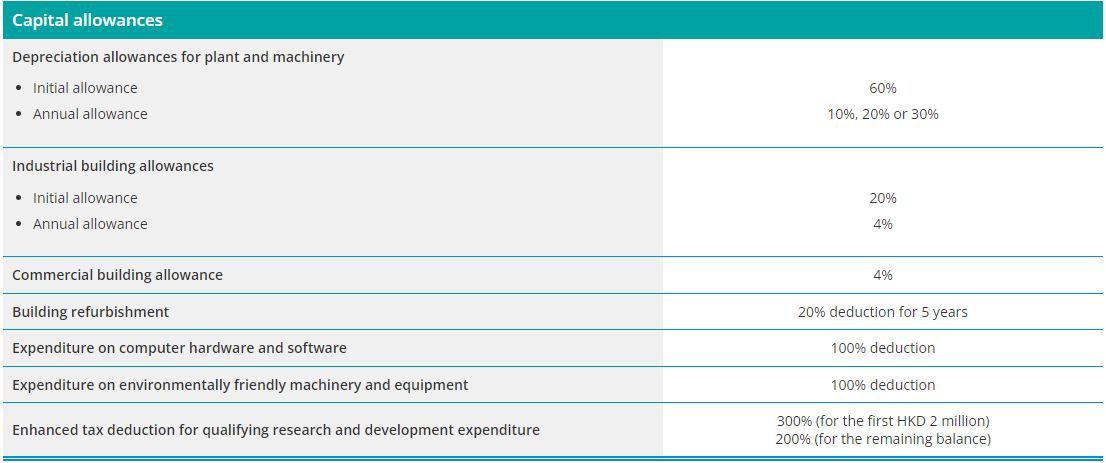

Hong Kong Tax Measures In Budget 2022 2023 Kpmg United States

A woman buys Malaysian ringgit from a money changer at The Arcade at Raffles Place.

. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Annual percentage growth rate of GDP at market prices based on constant local currency.

Resident companies are taxed at the rate of 24. Malaysia gdp growth rate for 2019 was 444 a 04 decline. Capital allowances consist of an initial allowance and annual allowance.

We have been providing two methods of training face to face and also online via Zoom Group or Individual Basic Beginner Intermediate or Advanced. 0138801776 Welcome to our page Microsoft Excel Training Solutions Malaysia. Property depreciation 101.

18 GST applies to most services. ABB Malaysia ABB Terra Jalan Lagoon Selatan 47500 Damansara Selangor. Avimur Solutions Sdn Bhd 1104442-K Petaling Jaya Selangor Contact No.

Refer to our handy GST Rate finder to check to find out the latest rates. Branches of foreign corporations in Malaysia are generally treated as non-residents in Malaysia unless it can be established that the management and control of its affairs or of its businesses or of any one of its businesses is exercised in Malaysia. KUALA LUMPUR Malaysia August 24 2022--Leading financial services company Northern Trust Nasdaq.

Call or WhatsApp. Intangible fixed assets must be amortised over a period of at least five years for tax purposes except research and development RD expenses for which the minimum amortisation period is three. Machinery and equipment depending on the type 20 or 33.

While annual allowance is a flat rate given. Analysts have raised their earnings forecasts for Heineken Malaysia Bhd after the brewing companys latest results for the first half ended June 30 2022 1HFY22 came in above their expectationsHong Leong Investment Bank HLIB Research said in a note on Monday Aug 15 that Heinekens 1HFY22 core net profit of. Even then the depreciation costs for EVs are.

Other factors may include mortgage payments property depreciation charitible donations additional voluntary retirement contributions. NTRS is expanding its philanthropy efforts in Malaysia aligned with its vision to create more. You can edit the depreciation settings for a particular asset but you cant change the accounts.

102018 Central Tax Rate. If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days. 5000 up to 31 Mar 2018.

Malaysian MM2H Application Process. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources. Malaysia gdp growth rate for 2021 was 313 a 878 increase from 2020.

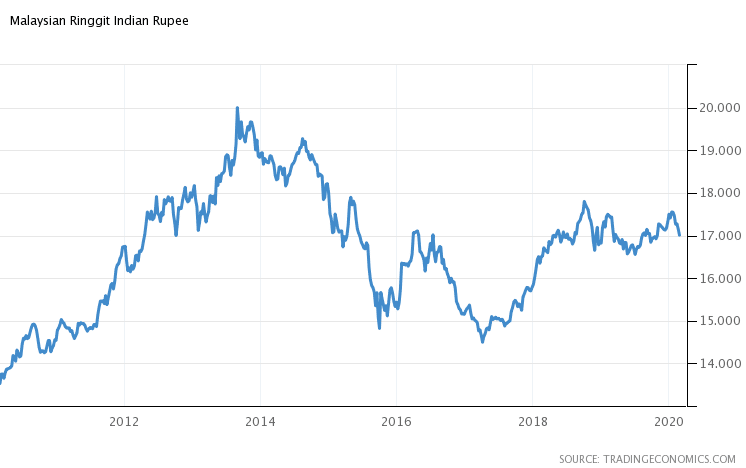

Malaysia gdp growth rate for 2020 was -565 a 1009 decline from 2019. Nine tips to help you claim the depreciation of your investment property against your taxable income. Just last year there was a significant dip in the currency.

GBP to THB currency chart. After reaching a high of 48 in 2020 the average 2022 unemployment rate is forecast to be 36. Current exchange rate MALAYSIAN RINGGIT MYR to US DOLLAR USD including currency converter buying selling rate and historical conversion chart.

Lets say your total billing to your client is Rs75000. A foreign company not carrying on business in Thailand is subject to a final withholding tax WHT on certain types of assessable income eg. XEs free live currency conversion chart for British Pound to Thai Baht allows you to pair exchange rate history for up to 10 years.

382017 Central Tax Rate This notification remove limit of rs. On the other hand compared to other Southeast Asian countries Malaysia has a much lower inflation rate. KUALA LUMPUR Aug 15.

The corporate income tax CIT rate is 20. Malaysias economy had grown 5 per cent in Q1 2022 compared to a contraction of 05 per cent in Q1 2021. All fields are mandatory.

Depreciation rate or effective life. Plant and equipment depreciation. GST rate is 18 ieRs.

Our Programs includes Spreadsheet. When you assign an asset type to a new fixed asset the types settings are automatically applied to the asset. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products.

Depreciation rate Commercial buildings. Notification No82017 Central Tax Rate This notification exempts RCM under section 94 up to Rs. Juwai IQI said it should hit 34 in 2023 close to 32 of the year before the pandemic.

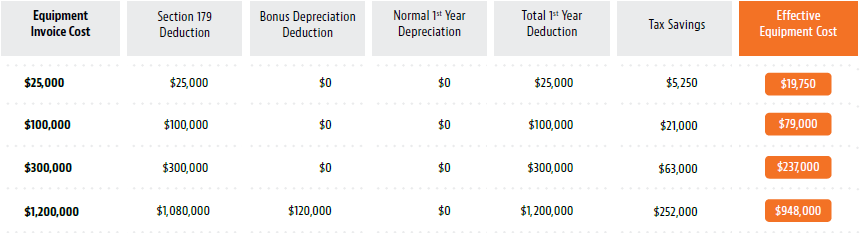

In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws. Aggregates are based on constant 2010 US. So for your freelancing services you must charge 18 GST from clients.

Whats the price rate for the pay-to-use. Marginal Tax Rate US. Interest dividends royalties rentals and service fees paid from or in Thailand.

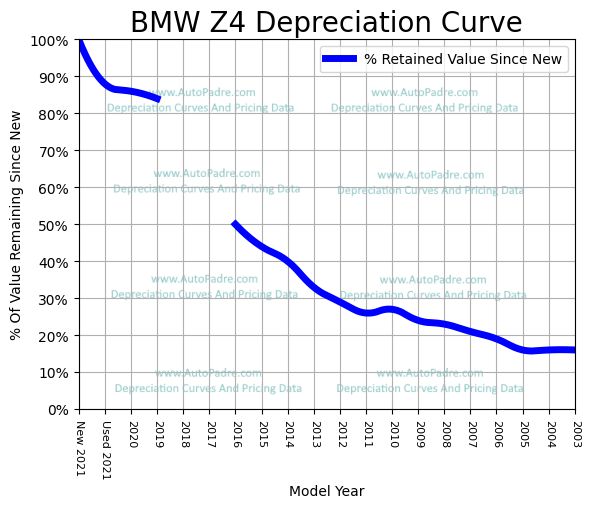

It is calculated without making deductions for depreciation of. However from an investment point of view you can expect depreciation. Read more are bifurcated into seven brackets based on their taxable income.

India Indonesia Malaysia. You need to choose one of depreciation rate or effective life.

Which Depreciation Method Is Best For You The Real Estate Conversation

Exchange Rate Changes Before Currency Crises The Graph Shows The Download Scientific Diagram

Will Capital Stranded By Covid 19 Be Productive Deloitte Insights

Solved Cash Account Receivable Merchandise Inventory Office Supplies Sale Supplies Pre Paid Insurance Office Equipment Accumulated Depreciation O Course Hero

Bmw Z4 Depreciation Rate Curve

A192 Ans Mc1 Ppe 1 Docx A192 Bkar2023 Financial Accounting And Reporting Ii Mc 1 Ppe Question 1 Diandra Bhd Is A Manufacturer And Supplier Of Men Course Hero

Accounting For Non Accountants Depreciation Of Plants And Machinery

Luxury Automotive Resale Value And Depreciation

Emerging Markets Monitor Archive Lazard Asset Management

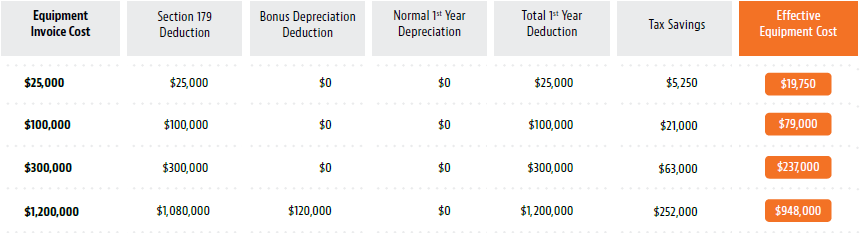

Section 179 And Bonus Depreciation Changes For 2021 Jlg

How The Depreciation Of The Ringgit Will Affect Singapore

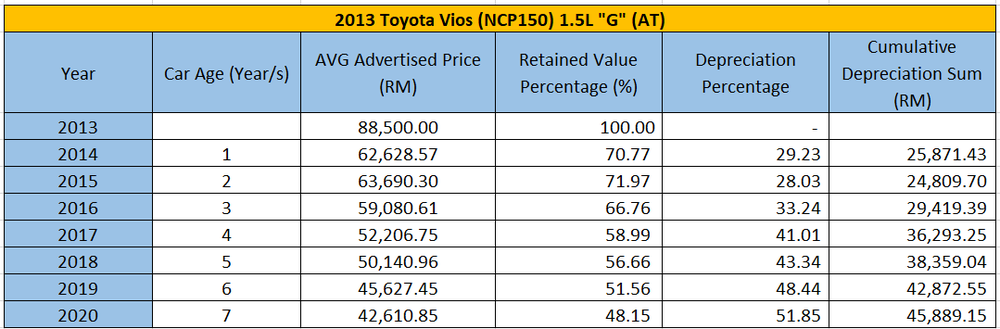

Icardata The Best Time To Buy Sell Toyota Vios Ncp 150 Insights Carlist My

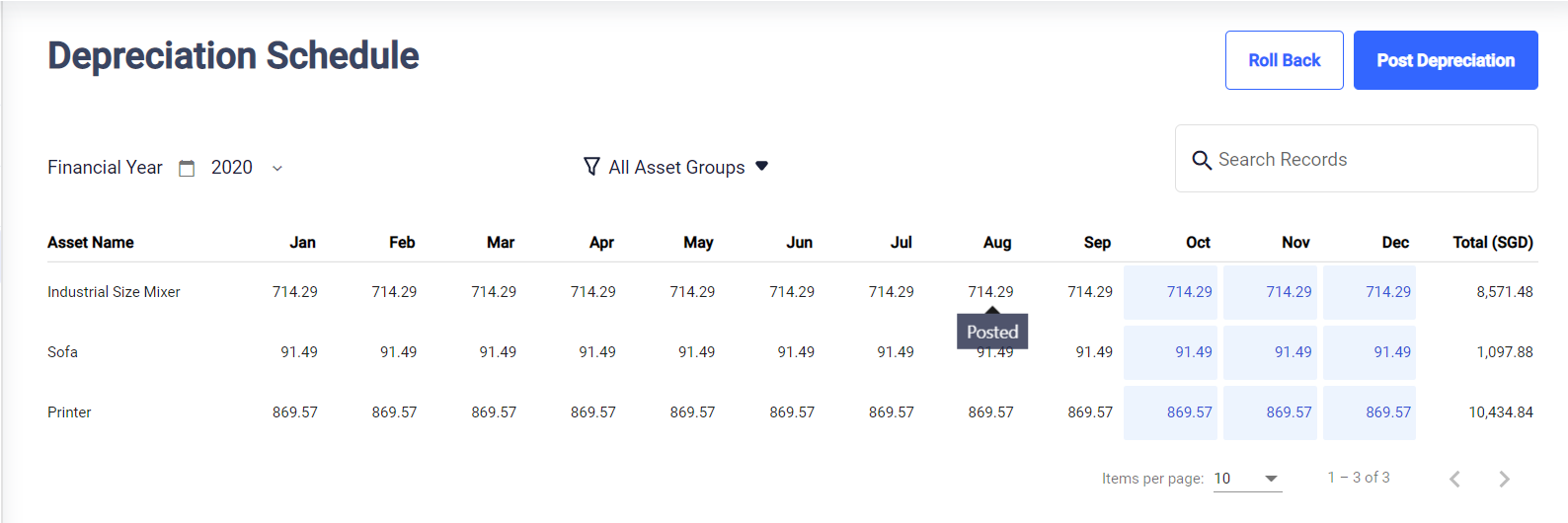

What Is Fixed Asset Everything You Need To Know About Fixed Assets

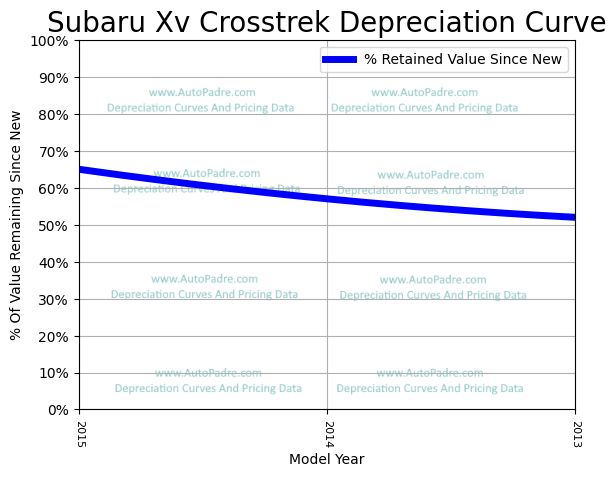

Subaru Xv Crosstrek Depreciation Rate Curve

Malaysia To See More Rate Hikes Before End 2022

Accounting For Non Accountants Depreciation Of Plants And Machinery

Malaysian Ringgit Forecast In 2020 Blog Best Foreign Exchange